Contribution Limits

It depends. The Program is prepared to calculate your contributions based on the plan’s design, eligible employees and compensation. This will allow you to maximize all available contributions while still adhering to the contribution limits. Respond to the compliance team’s solicitation email in January to have all applicable testing performed as well as contributions calculated.

There are three ways to submit contributions:

- With a check payable to ABA Retirement Funds Program (or a wire) along with a Contribution and Loan Repayment Remittance Form.

- Via Payroll/Administration through Sponsor Web.

- Via ProgramPay, a new payroll submission procedure, also through Sponsor Web.

Based on the method you elected in your adoption agreement, you will either use the funds in the forfeiture account to offset your employer contribution costs (most common) or reallocate the funds on an annual basis to the eligible participants. The Program can assist you in calculating a reallocation if that’s the method chosen.

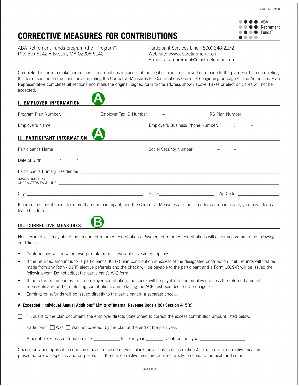

The Program can monitor the dollar limit for contributions (401(k) deferral limit as well as 415 annual additions limit). We can only monitor the percentage limit if we are also calculating your employer contributions for the year. If a participant does exceed one of the contribution limits, please submit a Corrective Measures for Contributions form. Use section 3A for excess contributions over the annual additions limit, or section 3B if the 401(k) deferral limit was exceeded.

Contribution Limits

The simplest way to think about contribution limits is in terms of layers.

Layer 1: limit imposed on the employer

For profit sharing plans, the total employer contributions cannot exceed 25% of aggregate eligible compensation of all eligible employees (note that 401(k) elective salary deferral contributions are not included in employer contributions for this limit). For money purchase pension plans, the total employer contributions allowed is also limited to 25% of aggregate eligible compensation. Bear in mind that the employer can meet this 25% limit in one plan or as a combination of contributions in multiple plans, but in no event can the employer exceed 25% of aggregate compensation.

Layer 2: limit imposed on the participant (“annual additions limit”)

For all contributions (including pre-tax elective contributions, after-tax employee contributions and Roth 401(k) contributions) to all employer plans in which the individual participates, contributions (and any forfeitures allocated to a participant’s account) cannot exceed the lesser of 100% of the participant’s eligible compensation and a prescribed indexed dollar amount. For 2023, the limit is the lesser of 100% of the participant’s eligible compensation and $66,000.

Layer 3: the dollar limit for elective contributions (including pre-tax elective contributions and Roth 401(k) contributions).

This dollar limit is indexed each year. The limit is $22,500 for 2023. The catch-up contribution limit for 2023 for a participant who attains age 50 before year-end is $7,500, for a total of $30,000.

Correcting contributions in excess of limits

If contributions in excess of the legal or plan limits have been made to the plan, use the Corrective Measures for Contributions Form to make corrections. The Corrective Measures for Contributions Form outlines each excess contribution reason. More detailed instructions, including deadlines, are attached to the form.

How to complete the Corrective Measures for Contributions Form

- The Authorized Plan Representative completes the employer and participant information.

- Determine if you have a violation, from the list in the box below the form.

- Only one subsection of section 3 should be completed.

How to complete the Corrective Measures for Contributions Form

- The Authorized Plan Representative completes the employer and participant information.

- Determine if you have a violation, from the list in the box below the form.

- Only one subsection of section 3 should be completed.