Investment Platform for the ABA Retirement Funds Program

Innovative fund menu designed with the participant in mind

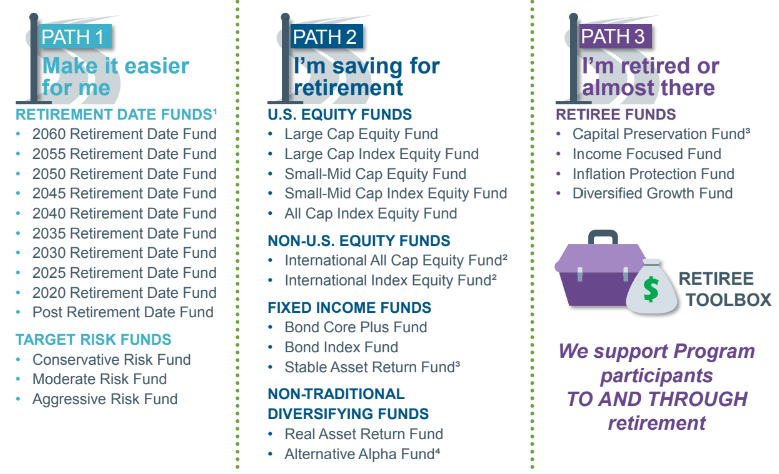

A diverse selection of investment options is important to ensure every participant has suitable choices to help meet his or her retirement goals. The Program has options for a variety of investors. The Program’s platform of investments is designed into three investment paths purposely built for all participants of the Program.

For additional details, including investment objectives, fees and expenses of the fund, portfolio turnover, principal investment strategies, primary risks, and total and average annual returns, please read the Program Annual Disclosure Document (April 2023). This Disclosure Document contains important information about the Program and investment options.

RISK FACTORS

The risk factors that pertain to investment in the Funds are described in detail in the description of each Fund included in the Program Annual Disclosure Document (April 2023).

These risk factors may include, but are not limited to, risks of investing in equity securities, risks of investing in equity securities of non-U.S. companies and smaller companies, interest rate risk applicable to investment in fixed-income securities, credit risk applicable to investment in fixed-income securities, including those of lower credit quality, risks of investing in REITs, risk of reliance on industry research, risks of investing in U.S. Government obligations, risks related to securities lending, risk of TBA commitments, risk of “when-issued” securities, risks related to market disruptions and governmental interventions, risks associated with structure of collective trust, and risks associated with commodity investments and derivatives.

The Collective Trust and the Funds are not Regulated Investment Companies or subject to SEC Disclosure Requirements. The Collective Trust and the Funds are not registered as investment companies under the Investment Company Act of 1940 and, therefore, are not subject to compliance with the requirements of that Act.

If you’d like to hear more about the Program and how we can help you and your employees to a secure retirement, please use the form below and one of our representatives will call you personally to discuss.

More information

1. Generally speaking, Retirement Date Funds target a certain date range for retirement, or the date the investor plans to start withdrawing money. Investors can select the Fund that corresponds to their anticipated retirement date or the point in time when they plan to start withdrawing money. These funds are designed to rebalance to a more conservative investment approach as the target date nears. An investment in a Retirement Date Fund is not guaranteed from investment loss at any time, including on or after the target retirement date.

2. Participants cannot make more than one transfer into the International All Cap Equity Fund or the International Index Equity Fund within any 45 calendar day period. There are, however, no restrictions on a Participant’s ability to make transfers out of these Funds on any Business Day.

3. Participants cannot directly transfer amounts from the Stable Asset Return Fund or the Capital Preservation Fund to their Self-Directed Brokerage Account. There are, however, no restrictions on transfers from the Stable Asset Return Fund or the Capital Preservation Fund to other Funds available under the Collective Trust, but an amount transferred from the Stable Asset Return Fund or the Capital Preservation Fund to any other Fund cannot, in turn, be transferred from that Fund to a Self-Directed Brokerage Account until 90 days after the date of this transfer. To the extent that an amount transferred from the Stable Asset Return Fund or the Capital Preservation Fund to another Fund is again transferred to yet another Fund or Funds, that amount cannot be transferred to a Self-Directed Brokerage Account until 90 days after the date of the initial transfer from the Stable Asset Return Fund.

4. Contributions to the Alternative Alpha Fund by or on behalf of a Participant may not exceed 15% of the total of the Participant’s investment elections. Transfers into the Alternative Alpha Fund from the Program’s other investment options by or on behalf of a Participant are limited to 15% of the aggregate Unit value of all of the Participant’s investments in the Funds as of the time of investment. These limitations are imposed by Mercer Trust Company as trustee of the Collective Trust in light of the Fund’s investment objectives, non-traditional strategies and non-traditional risks relating to these strategies.

5. Advisory Services provided by Voya Retirement Advisors, LLC (“VRA”). VRA is a member of the Voya Financial (“Voya”) family of companies. For more information, please read the Voya Retirement Advisors Disclosure Statement, Advisory Services Agreement and the Program’s Fact Sheet. These documents may be viewed online by accessing the advisory services link(s) through the Program’s website at abaretirement.com after logging in. You may also request these from a VRA Investment Advisor Representative by calling the Program’s information line at 800.348.2272. Financial Engines Advisors L.L.C. (“FEA”) acts as a sub advisor for VRA. FEA is a federally registered investment advisor. Neither VRA nor FEA provides tax or legal advice. If you need tax advice, consult your accountant, or if you need legal advice, consult your lawyer. Future results are not guaranteed by VRA, FEA or any other party, and past performance is no guarantee of future results. Edelman Financial Engines® is a registered trademark of Edelman Financial Engines, LLC. All other marks are the exclusive property of their respective owners. FEA and Edelman Financial Engines, L.L.C. are not members of the Voya family of companies. ©2023 Edelman Financial Engines, LLC. Used with permission.