Death Benefits

See this page of the online guide for the six pre-approved reasons for taking a hardship withdrawal. The firm will need to determine which documentation to require to approve the hardship withdrawal, and maintain it on file in the event the plan is audited.

Please see section 14 of your adoption agreement to determine the in-service withdrawal provisions that your firm chose for the plan.

For an in-service withdrawal, participants should use the In-Service Withdrawal Form. If the participant has terminated employment or meets one of the other reasons for the request in section 3 of the form, use the Distribution Request Form. On either form, rollover instructions can be entered in section 8.

When someone’s employment status changes, notify the Program by submitting a Participant Data Change Form. The Program will send the participant a postcard the following year notifying them of their distribution options by directing them to this webpage. Participants whose vested account balance is $5,000 or less cannot continue to maintain their account in your plan; the Program will notify them that their account will be included in the annual “cash out of small account” sweep if they take no action within 90 days of the notice.

The Program can confirm for you if we have a beneficiary designation on file. Once beneficiaries are determined, each claimant should submit a Death Benefits Claim Form (for multiple beneficiaries, all forms should be submitted together). The Program will also need one certified copy of the death certificate.

Death Benefits

Information on death benefits

In the event of a death claim, as the Plan Administrator, you will need to determine who the eligible beneficiaries are, as well as what forms of benefit payments are allowed under the plan.

Steps to request a death claim

1. Determine if a beneficiary is eligible to request benefits and what forms of payment are allowed; if applicable, send the beneficiary forms to complete along with the notice of taxable distribution

2. Decide on payment option and when to begin survivor benefits

3. Complete and send Death Benefits Claim Form to the Plan Administrator, along with a certified copy of participant’s death certificate

4. Send Death Benefits Claim Form and certified copy of the death certificate to the Program

5. Process Death Benefits Claim Form

6. Send check to beneficiary

7. Send IRS Form 1099-R to beneficiary and IRS

Determining eligibility for death benefits

As Plan Administrator, when a participant dies, you are responsible for checking the participant’s records to determine his or her named beneficiaries. The participant may have named both primary and contingent beneficiaries. You determine the beneficiary and what types of death benefits — if any — a named beneficiary may receive.

- If a participant dies after retirement benefits begin, then benefits continue to the named beneficiary, if any, provided the payment option elected by the participant allows for payments to continue to a beneficiary (such as the joint and survivor option). If the participant elected an annuity, the Program used the participant’s plan assets to buy an annuity from an insurance company. So, on the participant’s death, the insurance company — not the Program — needs to be notified by the beneficiary.

- If a participant dies before retirement benefits begin, then benefits will be paid based on the terms of the plan in which the participant was enrolled (check your adoption agreement and Article 6 of the Plan Document).

In addition, benefits will be paid according to whether the participant was single or married.

- If a participant is married at the time of death and if annuity payment options are not offered by the plan, benefits are paid to his or her spouse in a lump sum or another optional form of payment available under the plan and elected by the surviving spouse. However, with the spouse’s written and witnessed consent, the participant may have named a beneficiary other than his or her spouse.

- If a participant is married at the time of death and if annuity payment options are required by the plan, benefits are paid to his or her spouse in the form of a life annuity (unless the participant elected that 50%, rather than 100%, of his or her benefit be applied to provide his or her spouse with a benefit). This annuity pays monthly benefits to the spouse for the rest of his or her life. If the spouse wants a different form of payment, he or she may waive the annuity and elect another option.

- If a participant is single at the time of death, benefits are paid to the named beneficiary in a lump sum. However, the beneficiary may elect to receive any form of payment the participant was eligible to receive before his or her death.

If there is no beneficiary named at the time of the participant’s death, benefits will be paid to the first survivor(s) in the following categories:

- Surviving spouse

- Surviving children (including children of any deceased children)

- Surviving parents

- Surviving brothers and sisters

- Executor of the participant’s estate

Be sure to send a “Special Tax Notice Regarding Plan Payments,” “Notice of Benefits and Benefit Payment Form” and “Notice of Waiver and Election of Alternate Benefit Payment Form” to the beneficiary(ies) along with the Death Benefits Claim Form.

In order to process the death benefits, the Program will require an affidavit from the executor or administrator of the estate attesting to the name(s) of all next of kin and their relationship to the participant (including whether the participant had a child who predeceased him or her, and whether that deceased child had children and their names). Please also include documentation attesting to the appointed executor of the participant’s estate and a certified copy of the death certificate. If the beneficiary is a minor, the parent or guardian will need to provide a copy of the documentation attesting to the relationship of the minor to the deceased participant.

Beneficiary decisions

When payments begin

When a participant dies, the timing of payment to his or her named beneficiary is subject to strict rules.

If death occurs before payment begins, payment to a non-spouse beneficiary must begin before the end of the calendar year following the year the participant died and must be made over the beneficiary’s lifetime in an amount based on the beneficiary’s life expectancy unless the non-spouse beneficiary elects, by September 30 of the calendar year after the participant’s death, to receive all payments by the end of the fifth calendar year after the participant’s death.

If death occurs before payment begins, payment to a sole beneficiary who is the participant’s surviving spouse must begin no later than the end of the calendar year that the participant would have turned age 72 if the participant had survived, or, if later, the end of the calendar year following the year during which the participant died, and must be made over the spouse’s lifetime in an amount based on the surviving spouse’s life expectancy unless the spouse elects to receive all payments by the end of the fifth calendar year after the participant’s death. Such election must be made by the earlier of September 30 of (1) the later of (a) the calendar year after the year of the participant’s death and (b) the calendar year in which the participant would have attained age 72 and (2) the calendar year containing the fifth anniversary of the participant’s death.

Form of benefit payments

Generally, the payment options available to a participant are also permitted for the participant’s named beneficiary(ies). (See “Distributions” for more information about forms of payment.) However, there are some exceptions:

- A non-spouse beneficiary may roll over the distribution only to an inherited IRA.

- Before a beneficiary may roll over the account, the required minimum distribution may have to be paid if the participant was over age 72.

Requesting survivor benefits

To request survivor benefits, the surviving spouse or beneficiary(ies) must each complete a Death Benefits Claim Form. To request a quote for annuity payments, the beneficiary must also complete an Annuity Quote/Purchase Form. For direct deposits of installment payments to the beneficiary’s account at a bank or financial institution, the beneficiary must complete an Electronic Direct Deposit Form. When submitting the Death Benefits Claim Form to the Plan Administrator, the beneficiary must also include a certified copy of the participant’s death certificate (bearing a raised seal or ink stamp).

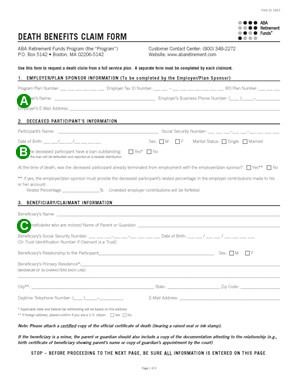

How to complete the Death Benefits Claim Form (page 1)

- The Plan Administrator completes the employer information that relates to the plan.

- The beneficiary completes the deceased participant information. Each beneficiary completes a separate Form.

- The beneficiary completes the claimant information and:

- Attaches a certified copy of the participant’s official death certificate.

- Includes any other required documentation (such as testamentary letters, affidavits, etc.).

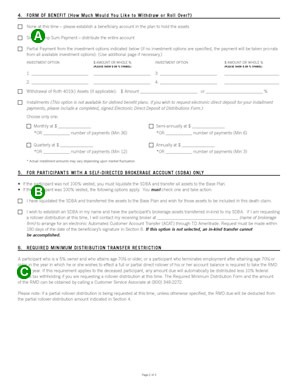

How to complete the Death Benefits Claim Form (page 3)

- The beneficiary completes the direct rollover instructions, if applicable.

- The beneficiary must sign and date the form. Then, the beneficiary sends the form to the authorized plan representative for signature.

Sending the form and death certificate to the program

Once you receive the beneficiary’s completed Death Benefits Claim Form, you must review and sign it as the Authorized Plan Representative. Send the completed Death Benefits Claim Form, certified copy of the death certificate, and, if applicable, affidavits and testamentary letters to the Program via mail. If the deceased participant’s account contained an SDBA, see “If the participant has an SDBA” in the Distributions section.

The Program will process the Death Benefits Claim Form upon receipt and send a check (if applicable) to the beneficiary. In January of the next calendar year, the Program will mail an IRS Form 1099-R to the beneficiary regarding any taxable distribution for the prior tax year.

Tax implications of death benefits

Under IRS rules, distributions to beneficiaries are subject to income taxes. Note that there is no additional tax for early payment. If the beneficiary is the participant’s surviving spouse, the plan must withhold federal income tax of 20% of the taxable portion of any distribution that is eligible for rollover, unless the surviving spouse completes a “direct rollover.” If the beneficiary is not the spouse, the taxable portion is subject to 10% voluntary federal income tax withholding (unless the beneficiary elects not to have any tax withheld or makes a direct rollover to an inherited IRA). The plan must also comply with any mandatory state income tax withholding rules (which vary by state). Beneficiaries (including spouses) will receive credit for payment of withholding taxes when they file their annual tax returns for the year in which the distribution was made. Also, beneficiaries who want to elect additional withholding from the payment may complete IRS Form W-4P before receiving the distribution. Form W-4P must accompany the distribution paperwork.

Surviving spouses who receive a check payable to them can roll over the full distribution amount within 60 days of their receipt of the check. However, to roll over the entire amount of the payment, the surviving spouse should, but is not required to, find other money to replace the 20% that was withheld for the federal income tax. The surviving spouse receives credit for the taxes paid when he or she files his or her federal income tax return for that year. If the surviving spouse only rolls over the 80% that was received, he or she will still be taxed on the 20% that was withheld and not rolled over. This option is not available to non-spouse beneficiaries — they can only make a direct rollover.

Amounts rolled over will not be taxed until the beneficiary receives a payment from the IRA or other eligible account to which the distribution was rolled over.

Both a surviving spouse and other designated beneficiary may be able to use the special tax treatment for lump-sum distributions. The beneficiary should see his or her tax advisor for more information.

Timing of distribution

The Program will mail a check (if applicable) to the beneficiary within two business days from when the death claim is processed.

Avoiding a tax penalty on death benefits

The surviving spouse can avoid paying current withholding taxes and penalties by requesting a direct rollover to:

- An individual retirement account (IRA), or

- An eligible employer-sponsored plan.

A non-spouse beneficiary can request a rollover only to an inherited IRA (an IRA opened exclusively for purposes of receiving the rollover from the retirement plan).

Note: These are general tax guidelines. Beneficiaries should always be directed to seek tax advice from their legal or tax advisor.