Plan Pricing Information for the ABA Retirement Funds Program

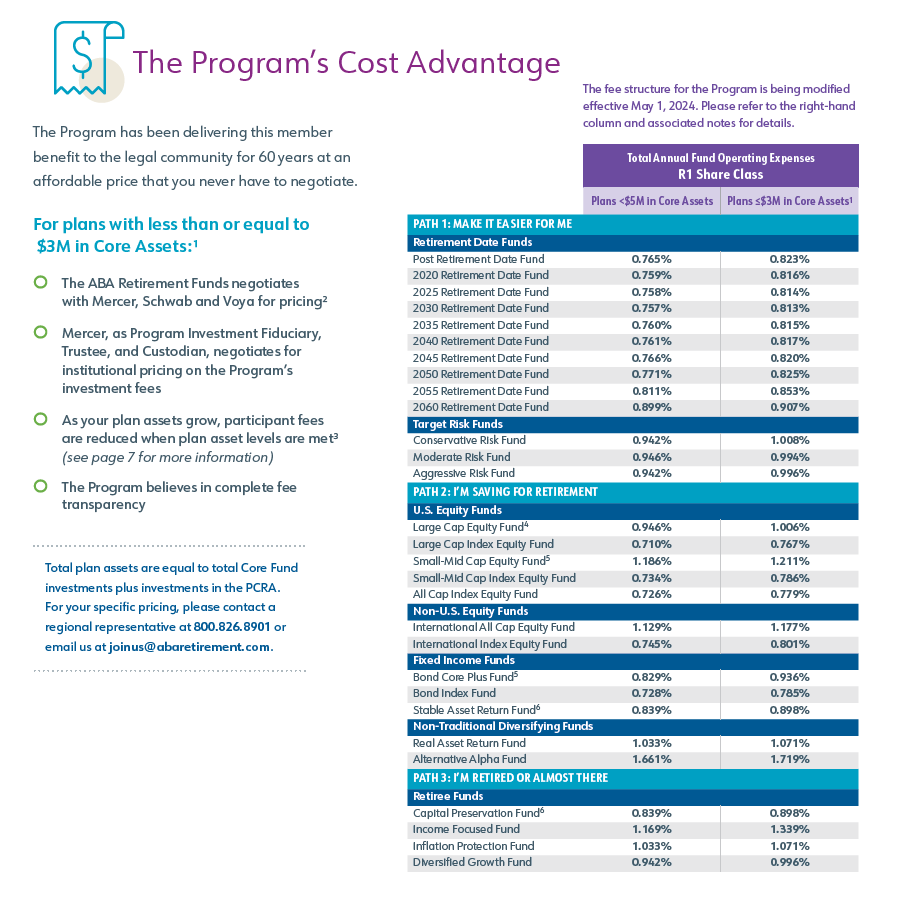

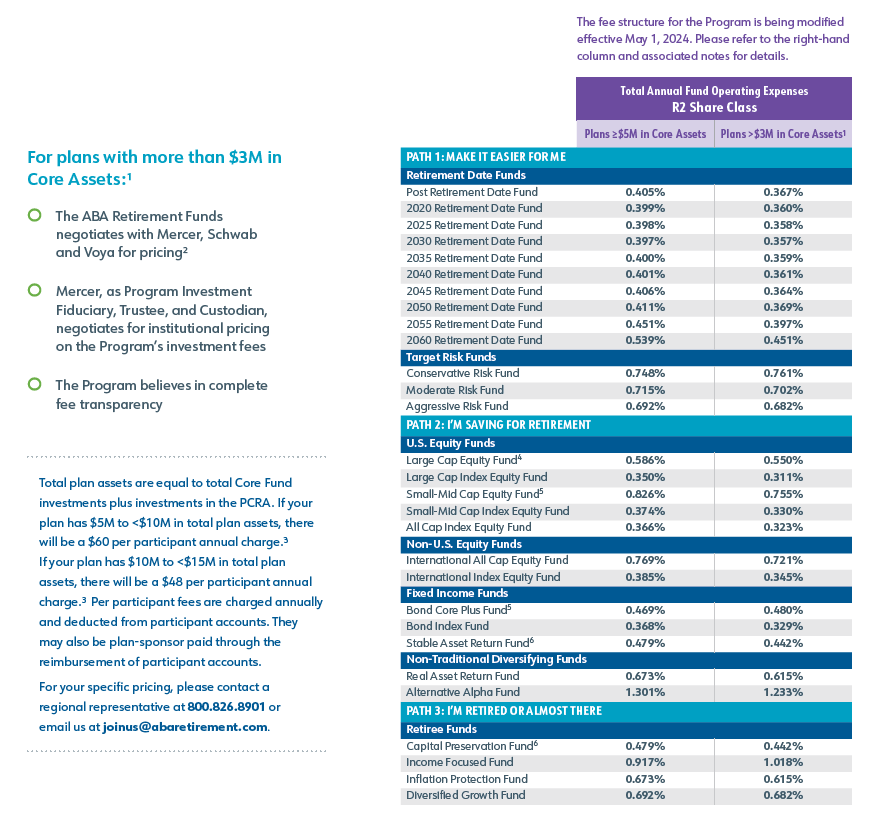

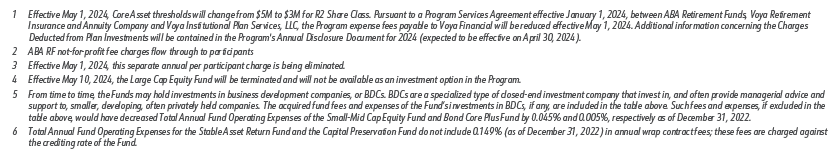

THE PROGRAM’S COST ADVANTAGE

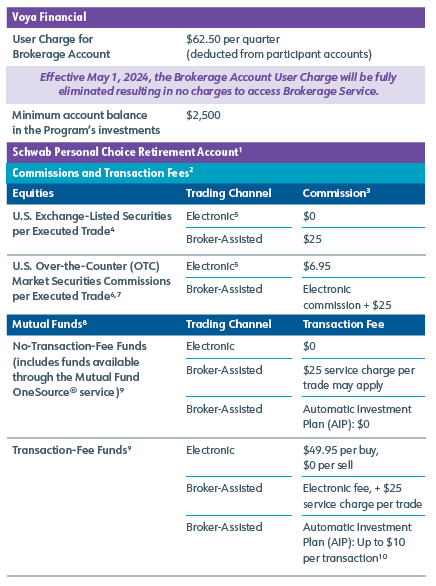

OPTIONAL PARTICIPANT SERVICES AND PRICING

We understand that different participants have different needs when it comes to their retirement plan. The Program offers the following optional services to meet the unique needs of your participants.

Self-Directed Brokerage services

The participant who wants more control over the selection of individual stocks, bonds or mutual funds can take advantage of the self-directed brokerage window offered by Schwab.

Schwab Personal Choice Retirement Account® (“PCRA”) is offered through Charles Schwab & Co., Inc. (“Schwab”), a registered broker-dealer that also provides other brokerage and custody services to its customers. © 2023 Charles Schwab & Co., Inc., (Member SIPC). All rights reserved.

investment advisory services

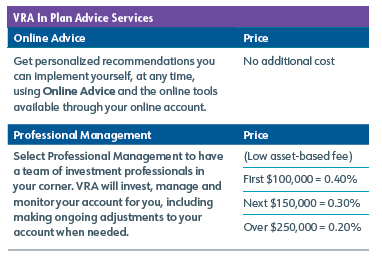

Participants looking for investment advice can take advantage of the advisory services provided by Voya Retirement Advisors, LLC (“VRA”), powered by Edelman Financial Engines,† either Online Advice (no charge to you) or via Professional Management. Participants electing to receive Professional Management services will incur a monthly charge payable directly from their account based upon the following fee schedule:

Retirement Financial Planning Services

Plan participants can take advantage of holistic financial planning services in two ways.‡

1. Financial Snapshot – Complimentary/free of charge: Get access to a financial professional who will work with you to create a personalized Financial Snapshot that will provide you with steps you can take to help you achieve your financial goals.

2. Full Financial Plan – Up to $1,500: The Full Financial Plan provides an in-depth analysis for those with more complex financial situations, addressing strategies for your financial goals, and offering continued access to a financial professional to discuss your financial situation and to implement any action steps you choose.

† Advisory Services provided by Voya Retirement Advisors, LLC (“VRA”). For more information, please read the Voya Retirement Advisors Disclosure Statement, Advisory Services Agreement and your plan’s Fact Sheet.

‡ Financial Professionals are Investment Adviser Representatives and Registered Representatives of Voya Financial Advisors, Inc. (member SIPC).

If you’d like to hear more about the Program and how we can help you and your employees to a secure retirement, please use the form below and one of our representatives will call you personally to discuss.