As you are well aware by now, the stock market encounters volatility and ups and downs. While these shifts can increase anxiety, we know a few things for sure. No one can predict what the market will do and when.

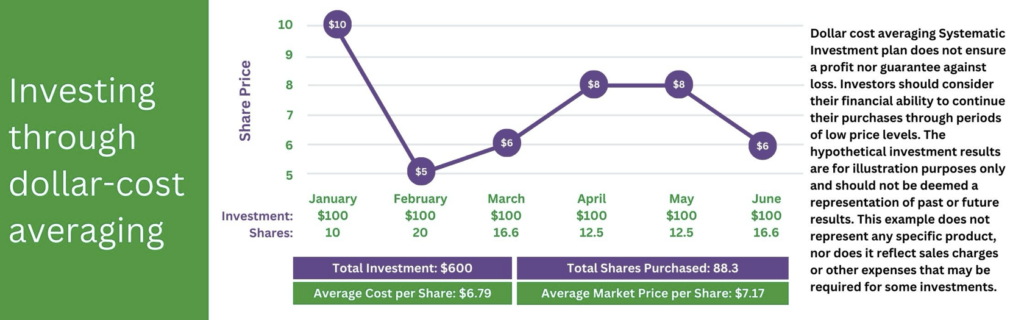

History and time have shown that volatility often has an upside, especially when you use the dollar-cost averaging approach. The dollar cost averaging approach is an investing technique where you invest in the market by contributing a set amount on a regular schedule – which takes the guess work out of timing the market and can help you save for your future. Remember, investing is more of a marathon – not a sprint. Here is how dollar-cost averaging works.

Investing for everyone

What is dollar cost averaging? It’s pretty simple, actually. For example, start with a modest sum of money – say $100. (Possibly even less – many firms will let you set up an automatic investing plan for as little as $50 a month.) You use that money to buy as many shares of a given stock, bond or mutual fund as you can. The next month, you do the same. You may be able to automatically deduct the amount from your bank account each month, so you won’t even have to think about it.

How it works

Over time, the $100 monthly investment purchase will start to add up. The price of each investment may rise and fall, meaning your monthly purchase will buy fewer shares in some months, and more in others. But over time, your average share price could actually be lower than if you had invested a large sum all at once – and because you’re spreading your investments over time, you don’t have to be concerned about market timing. You can always increase your monthly stock purchase if your finances allow it. But even if you keep your monthly purchase the same, your portfolio can grow – especially if you invest consistently over a long period of time.

Stick with it

Stick with it and you could watch your initial, modest investment grow into something much more substantial. Of course, all investments have risk, and dollar-cost averaging can’t guarantee a profit or prevent losses in declining and volatile markets. But for those new to the markets, or those with a limited budget, it could be a great way to enter the investing arena.

Markets will always fluctuate. In the 20th century alone the U.S. endured two world wars and other traumatic conflicts; the Great Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. However, despite all of that, the Dow rose from 66 to 11,497.”[1] We encourage you to consider staying the course – because everything worthwhile always takes time

Dollar cost averaging is a system for investing a fixed amount of money at regular intervals over a period of time, in an effort to reduce market timing risk. It means investing smaller amounts of money in the market at regular intervals rather than large amounts all at once. Dollar cost averaging does not ensure a profit or guarantee against loss in declining markets. Investors should consider their financial ability to continue their purchases through periods of low price levels.

[1] Inc. Magazine, Warren Buffett’s Best Advice on Navigating Stock Market Crashes, September 2019, Wright Chief marketing technologist, CCP Global, December 09, 2019

This material is provided for general and educational purposes only; it is not intended to provide legal, tax or investment advice. All investments are subject to risk. We recommend that you consult an independent legal or financial advisor for specific advice about your individual situation.

Please read the Program Annual Disclosure Document (April 2020) carefully before investing. The Annual Disclosure Document contains important information about the Program and investment options. For email inquiries, use: contactus@abaretirement.com.

Registered Representative of and securities offered through Voya Financial Partners, LLC (member SIPC).

Voya Financial Partners, Voya Retirement Advisors, and Voya Financial Advisors are members of the Voya family of companies (“Voya”). Voya and the ABA Retirement Funds are separate, unaffiliated entities, and not responsible for one another’s products and services.

CN3775726_0826