Improving participant outcomes means going beyond the retirement plan. A recent survey of plan sponsors and participants uncovered some critical issues.1

- Financial stress affects everyone. Research shows that money problems account for 59% of employees’ stress in the workplace, which can affect their mental and physical well-being and their performance at work.2

- Financial stress can cause a delayed retirement. Over half of the financially stressed employees surveyed plan to postpone their retirement—at an average cost to an employer of $51,000 per employee.3 Delayed retirement can also mean delayed career trajectories for newer workers.

- Financial wellness programs help with employee retention. Workers generally view their employers as a trusted source. That creates an opportunity for sponsors to retain employees by offering support in key areas, including improving overall financial wellness and retirement income planning.

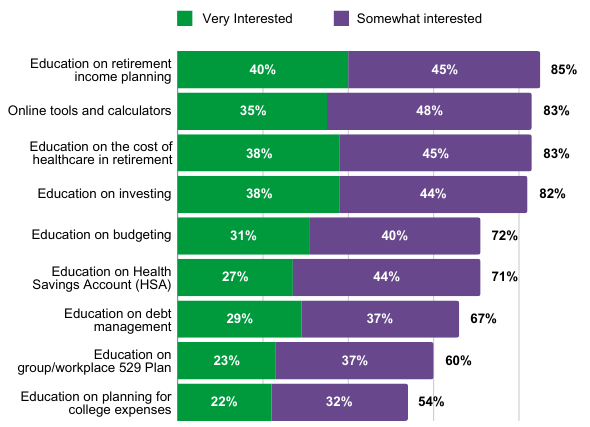

The good news is that defined contribution (“DC”) plan sponsors and participants have become increasingly aware of the importance of financial wellness and how it can improve outcomes. In Voya IM’s 2023 Survey of the Retirement Landscape: Plan Sponsor Perceptions, sponsors indicated that financial wellness is a critical area of focus. And in the related Participant Sentiments survey, more than 80% said they are very or somewhat interested in financial wellness programs through their employer—especially education on retirement income planning, health care costs and investing (Exhibit 1).

Exhibit 1. Participants are asking their employers for help with financial wellness in a number of areas.

4 areas of financial wellness focus for plan sponsors

1. Financial decision-making

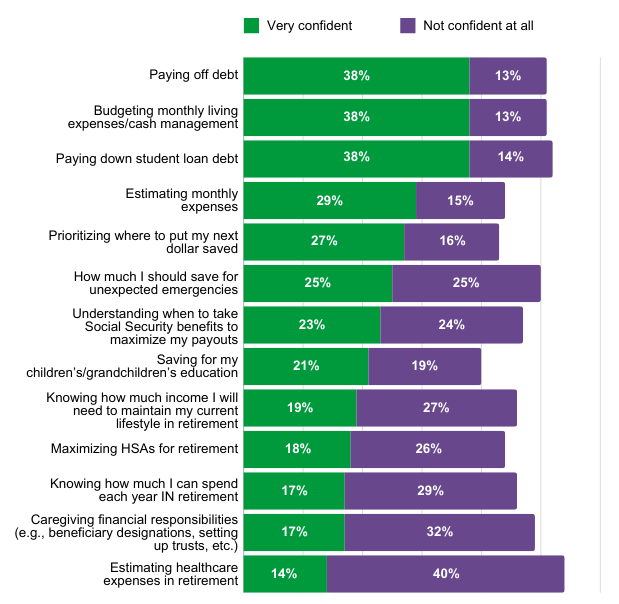

The issue: In making financial decisions, participants said they are fairly confident about how to pay off debt and budget for monthly living expenses. But their confidence began to decline when considering how to estimate monthly expenses, how to prioritize where to save and how much to set aside for unexpected emergencies (Exhibit 2). Importantly, Black and Latino employees have lower levels of financial confidence than White and Asian employees.

Exhibit 2. Participants are more confident about general budgeting, but less sure about retirement-related decisions.

The solution: Employers with a thoughtfully designed financial wellness platform can make it easy for participants not only to see the big picture, but to act on it. Offering employees access to online financial planning tools and a comprehensive financial education program are two ways to help increase their financial confidence, as is working with an advisor or specialist who can directly interact with employees.

2. Retirement education

The issue: The research shows that many participants don’t have a plan for their DC assets when they retire. This finding was significantly higher among women (47%) than men (28%). White, Black and Latina women all lag men of their respective racial/ethnic group in savings rates and average account balances, which suggests an opportunity for sponsors to provide specialized retirement education and support for female workers.

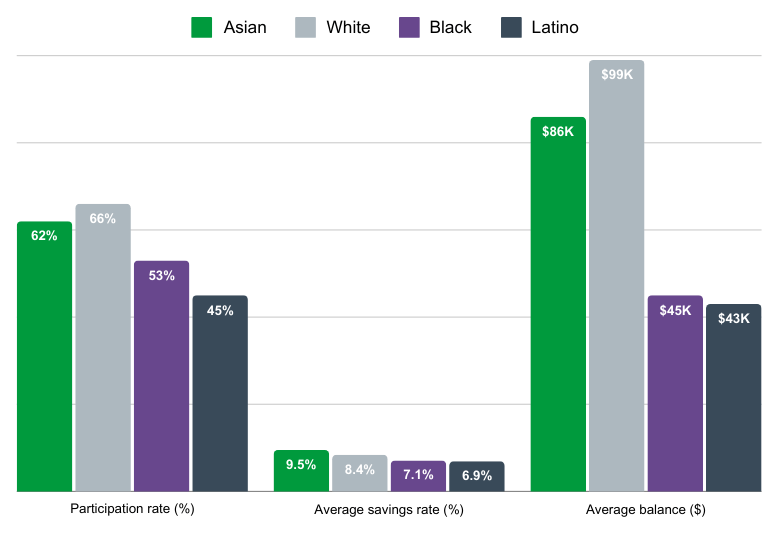

The research also found that, on average, Black and Latino employees exhibit lower retirement plan participation, lower savings rates and smaller average account balances compared with Asian and White employees (Exhibit 3).

Exhibit 3. Black and Latino workers lag White and Asian workers in retirement savings.

As of 06/30/22. Source: Voya Financial DEI Analysis report.

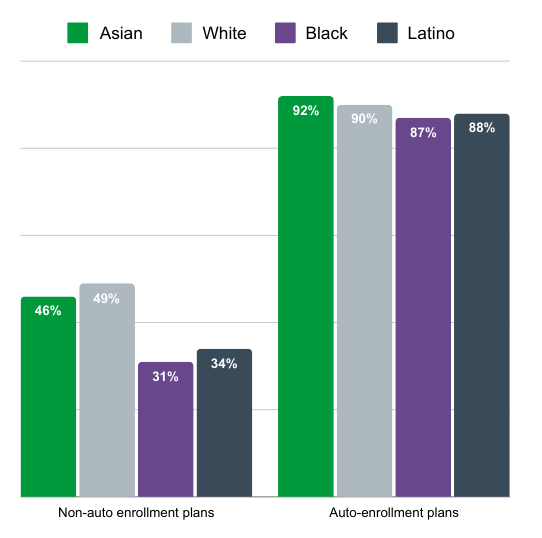

The solution: Auto-enrollment and step-up plan features are a powerful tool to even the playing field. Black and Latino employees that have access to retirement plans with auto enrollment have a participation rate that is two to three times higher than their peers at employers with plans that don’t offer auto enrollment (Exhibit 4).

Exhibit 4. A retirement plan with auto features can improve Black and Latino participation rates

Participation rate – % of employees actively contributing.

3. Investment education

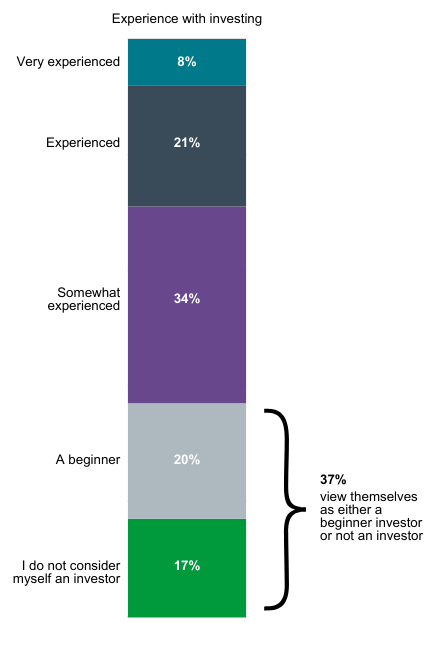

The issue: According to the research, many employees don’t view themselves as experienced investors, and they want more investment education (Exhibit 5). Areas of interest include retirement income, managed accounts and financial wellness. One concerning observation in the research is that 20% of participants don’t know how they invest within their DC plan—a finding that was significantly higher among female respondents.

Exhibit 5. Most employees could use additional support in making investing decisions.

The solution: Participants are looking for assistance in making investment decisions. 80% expressed interest in having access to a financial professional who can answer their questions and provide investment education and advice. They also indicated strong interest in education about retirement income, managed accounts, and plan auto features. Many of these products/services help address areas in which participants cited low levels of confidence.

4. Student loan repayment support

The issue: Student loan debt is now the second-largest debt category, behind only home mortgages. According to the research, 95% of employees with student loan debt would be more likely to save more for retirement if they felt like their student debt was under control.

The solution: Employers can implement a number of approaches to help employees pay down student loan debt, including tuition assistance, loan contributions, student loan benefit offerings and retirement plan match programs.

Student loan debt can represent a substantial percentage of younger workers’ income and can keep them from making meaningful retirement plan contributions. The Secure Act 2.0 allows for a flexible employer match design that may help these employees save more, increase their retirement confidence and reduce financial stress. The ABA Retirement Funds Program now allows participants to benefit from employer matching contributions to their retirement plan while making student loan payments, allowing greater flexibility to receive the retirement plan match.

Consider the ABA Retirement Funds Program

The ABA Retirement Funds Program offers a different kind of retirement plan; Built by Lawyers and Powered by Pros®. Contact us to learn more about how the Program can help you incorporate these wellness solutions into your retirement plan.

CN3753811_0826

1 Voya IM: 2023 Survey of the Retirement Landscape

2 PwC 2023 Employee Financial Wellness Survey

3 Voya internal data. Assumptions: An incremental aggregate cost of $51,000 for every individual whose retirement is delayed by three years. This cost is estimated assuming that a 65-year-old employee is not replaced by a mid-career employee for three additional years, and assumes a flat 31% cost of benefits as per Bureau of Labor average.

This information is for educational purposes only; it is not intended to provide legal, tax, or investment advice. All investments are subject to risk. Please consult an independent tax, legal, or financial professional for specific advice about your individual situation. Each business must consider the appropriateness of the investments and plan services offered to its employees.

The ABA Retirement Funds Program is available through the American Bar Association as a member benefit.

Registered representative of and securities offered through Voya Financial Partners, LLC (member SIPC).

Voya Financial Partners is a member of the Voya family of companies (“Voya”). Voya, the ABA Retirement Funds, and the American Bar Association are separate, unaffiliated entities, and not responsible for one another’s products and services.