Tier I Pre-Mixed Diversified Funds

Retirement Date Funds

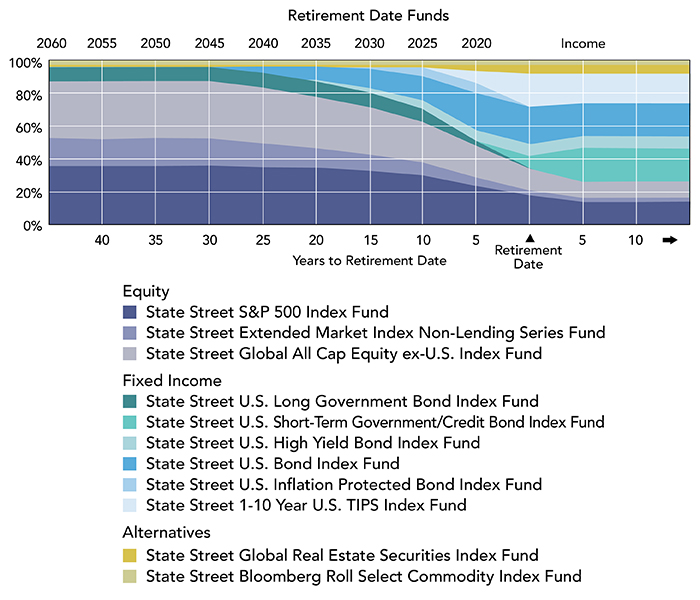

The Collective Trust offers the following 10 Retirement Date Funds, a group of diversified investment funds each of which makes investments among different asset classes and is designed to correspond to a particular time horizon to retirement: Income Retirement Date Fund, 2020 Retirement Date Fund, 2025 Retirement Date Fund, 2030 Retirement Date Fund, 2035 Retirement Date Fund, 2040 Retirement Date Fund, 2045 Retirement Date Fund, 2050 Retirement Date Fund, 2055 Retirement Date Fund, and 2060 Retirement Date Fund. Read More

As you near retirement and move left to right along the glide path, the Fund’s investment mix automatically shifts to a greater allocation of more conservative investments such as bonds. For a complete description of these Funds, including their specific objectives, investment strategy, investment managers, and associated risks please refer to the Program Annual Disclosure Document (April 2018) as supplemented (March 2019).

The below information is as of 12/31/2018. On or around 9/16/2019, the pricing structure for the Program will be changing. For more information regarding these changes, please refer to the Supplement to the Annual Disclosure Document. Just log into your account at www.abaretirement.com, click on Investments and then click on Fund Information.

Retirement Date Funds

| Type | Expenses | Morningstar Fund Profile |

|---|---|---|

| Income Retirement Date Fund: | 0.663% | Download |

| 2020 Retirement Date Fund: | 0.651% | Download |

| 2025 Retirement Date Fund: | 0.653% | Download |

| 2030 Retirement Date Fund: | 0.651% | Download |

| 2035 Retirement Date Fund: | 0.657% | Download |

| 2040 Retirement Date Fund: | 0.654% | Download |

| 2045 Retirement Date Fund: | 0.666% | Download |

| 2050 Retirement Date Fund: | 0.679% | Download |

| 2055 Retirement Date Fund: | 0.813% | Download |

| 2060 Retirement Date Fund: | 0.997% | Download |

There can be no assurance that the Funds will achieve their investment objective. Furthermore, the Funds do not guarantee participants will meet their income needs for retirement.

Target Risk Funds

The Collective Trust offers the following three Target Risk Funds, each of which allocates its investments among different asset classes and is designed to represent risk and potential reward characteristics that reflect a particular level of investment risk: Conservative Risk Fund, Moderate Risk Fund and Aggressive Risk Fund.

| Type | Expenses | Morningstar Fund Profile |

|---|---|---|

| Conservative Risk Fund: | 0.737% | Download |

| Moderate Risk Fund: | 0.760% | Download |

| Aggressive Risk Fund: | 0.819% | Download |

For additional details, including investment objectives, fees and expenses of the fund, portfolio turnover, principal investment strategies, primary risks, and total and average annual returns, please read the Program Annual Disclosure Document (April 2018) as supplemented (March 2019). This Disclosure Document contains important information about the Program and investment options. For e-mail inquiries, contact us at: [email protected].

The risk factors that pertain to investment in the Funds are described in detail in the description of each Fund included in the Program Annual Disclosure Document (April 2018) as supplemented (March 2019). These risk factors may include, but are not limited to, risks of investing in equity securities, risks of investing in equity securities of non-U.S. companies and smaller companies, interest rate risk applicable to investment in fixed-income securities, credit risk applicable to investment in fixed-income securities, including those of lower credit quality, risks of investing in REITs, risk of reliance on industry research, risks of investing in U.S. Government obligations, risks related to securities lending, risk of TBA commitments, risk of “when-issued” securities, risks related to market disruptions and governmental interventions, risks associated with structure of collective trust, and risks associated with commodity investments and derivatives.

The Collective Trust and the Funds are not Regulated Investment Companies or subject to SEC Disclosure Requirements. The Collective Trust and the Funds are not registered as investment companies under the Investment Company Act of 1940 and, therefore, are not subject to compliance with the requirements of that Act.