Are you willing to take the risk?

Which fiduciary protection option will you select for the management of your retirement plan?

By: Scarlett Ungurean, ABA Retirement Funds Executive Director

There are advantages to offering a retirement plan for employees, from attracting key talent to helping companies reduce their tax burden. The good news is that there are financial professionals, who can act in the interest of the employer that sponsors a plan (plan sponsor) and provide oversight for fiduciary duties.

Professional fiduciaries now commonly exist to support plan sponsors in their oversight responsibilities with respect to a retirement plans and reduce the level of risk sponsors may take on when offering a workplace savings account to their employees.

One less thing to worry about sounds like an overall win, right?

What are your options?

Designated fiduciaries are available to help you. Under ERISA (Employee Retirement Income Security Act), Department of Labor regulations, there are several types of retirement plan fiduciary professionals who you can hire to act on your behalf: investment and plan related fiduciaries and administrative fiduciaries.

DOL defines plan and investment fiduciaries options as: a 3(21), 3(38), or an independent trustee that has full discretion.

- 3(21) fiduciaries. They are hired to help provide you suggestions for the investment menu and you as the plan sponsor can accept or reject the 3(21) recommendations. Think of this as your investment advisor.

- 3(38) fiduciaries. They make the decision about what to include as investment options and manage not only what’s on the menu but the hiring and firing of the investment managers that run the funds. Think of this as your main investment manager that looks after all investment related matters. This solution requires that you complete a search for a 3(38) that will act in the best interests of the plan and participants in an independent capacity.

- Trustee fiduciaries. If you hire an organization to act as trustee, it holds plan assets and performs all 3(38) services, so your only responsibility is to monitor the trustee to ensure that it is prudently completing its duties.

Few providers, such as the ABA Retirement Funds Program (“Program”) have a governing Board of Directors that selects and monitors the trustee in a fiduciary capacity on your behalf. This model is the highest standard of fiduciary delegation allowable under ERISA.

ERISA defines 3(16) plan administrators. For a more “hands-off” experience (you will never really be completely “hands-off”), you can hire a 3(16) plan administrator to administer the day-to-day duties and minimize the work and risk on your end. Some of the 3(16) responsibilities are considered to be fiduciary, while others are only administrative. The administrator’s fiduciary duties include taking responsibility for administrative tasks associated with the plan like keeping the plan compliant and filing government related filings. It’s important to determine what responsibilities are being taken care of by your 3(16) administrator, so you should review the checklist you receive to make sure your expectations are being met.

For these services, make sure you confirm in writing that your provider is accepting fiduciary responsibilities for which they are being hired.

Controversies and Class Action Lawsuits

If you want to do your best to avoid being involved in controversies –it’s important to adhere to the standard practices and guidelines regarding your retirement plan. Delegating a professional to stay on top of day-to-day fiduciary duties will limit the possibility of being fined or your exposure to litigation down the road.

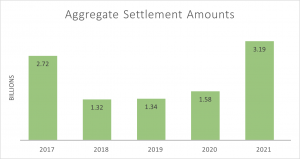

The top aggregate settlements in 2021 totaled $3.19 billion, more than double the 2020 total, largely as a result of “class action filings challenging defined contribution plan (401(k) and 403(b) plan) fees and investments,” according to law firm Seyfarth Shaw’s annual report on workplace class-action settlements.

Record class action settlement numbers—$3.19 billion in 2021 as compared to $1.58 billion in 2020 and $1.34 billion in 2019 according to Seyfarth Shaw’s annual report on workplace class-action settlements.

While most lawsuits related to workplace savings are related to investments and specifically high fees within investments, hiring a trustee or a 3(38) fiduciary can be advantageous to those who want to delegate 401k plan investment associated burdens and risks.

It’s important to weigh your options and figure out what best works for your business. The Program is here to help you navigate your choices. Check out our website, abaretirement.com. For more information on how we can assist you with your fiduciary needs, contact us Monday through Friday, 9:00 a.m. – 5:00 p.m. ET by phone at 800.826.8901 or by email at [email protected].

This material has been provided for educational purposes only for sponsors and prospective sponsors. It was created to provide accurate and reliable information on the subjects covered and should not be considered tax, legal, or investment advice. Each plan must consider the appropriateness of the investments and plan services offered to its participants.

CN2244622_0624