Participant Communications

The Program offers year-end and mid-year nondiscrimination testing for 401(k) plans, top heavy testing for all plans, and contribution calculations. Respond to our solicitation email in the first month of your plan year begins to request these services, offered at no additional cost. The Program will reach out to you in the eighth month of the plan year to offer a mid-year nondiscrimination test if you sponsor a non-safe harbor 401(k) plan.

Form 5500 is an annual report that informs the government regarding demographic and financial information for the plan. It is an important tool that allows regulators to monitor retirement plan trends. The filing deadline is the last day of the seventh month following your plan year-end. The Program will prepare and provide Form 5500 to be filed through our eFile website and email you the filing notifications when it is ready to be filed.

The Program will ensure that the master and prototype plan is in regulatory compliance, if you have adopted the prototype. To ensure that your plan is in operational compliance, see the compliance checklist.

Participant Communications

The following table summarizes the communications the Program provides for participants:

| The Program Provides | To Employee / Participant | To Plan Administrator |

| Enrollment Package for New Participant | Available online when employee becomes eligible to participate | On your request (as many kits as needed)* |

| Summary of Disclosure Document | When updated and as requested | When updated and as requested |

| Annual Disclosure Document | Online after login and as requested | When updated and as requested |

| Summary plan description (SPD) | Upon inquiry, the Program will refer participant to the Plan Administrator to request a copy | Automatically if it is a new plan or if there has been an amendment (you must distribute to your participants either electronically or by paper) |

| Summary of material modifications (SMM) | Upon inquiry, the Program will refer participant to the Plan Administrator to request a copy | Automatically, if there has been a material amendment (you must distribute to your participants either electronically or by paper) |

| Summary annual report (SAR) | Upon inquiry, the Program will refer participant to the Plan Administrator to request a copy | Automatically with the annual report Form 5500 (you must make copies and distribute to your participants) |

| Participant Disclosures and Investment Glossary | Automatically on an annual basis, to those participants and eligible employees recorded on the Program’s recordkeeping system. Included with the Enrollment Kit for those employees just satisfying eligibility, and on an ad hoc basis if there are any changes to the information. The Investment Glossary is available on the home page of the Program’s website. | Upon request, should you need a copy to send to an employee not recorded on the Program’s recordkeeping system. |

| Quarterly and Annual statement | Automatically to active and terminated participants who maintain a balance in the plan, unless the participant has elected online statements | Automatically on a quarterly and annual basis, showing plan totals and forfeiture account activity |

| Confirmation notice of a transaction | Automatically for active and terminated participants for transfers, investment election changes, address changes, marital status changes, name changes and beneficiary changes | Automatically for contributions and loan repayments |

| Required Minimum Distribution (RMD) Notice | SECURE 2.0 increased the required minimum distribution age further to 73 starting on January 1, 2023 – and increases the age further to 75 starting on January 1, 2033. Automatically for participants who attain age 73 (75 in 2033) in that year. | |

| IRS Form 1099-R | Automatically for participants who received a distribution, withdrawal or whose loan defaulted (or was deemed distributed) during that tax year |

The Participant Statement

The Program automatically sends statements to every participant online or by mail. To elect to receive their statements and confirmation notices of transactions online instead of in the mail, participants should:

- Visit www.abaretirement.com and log in to their account.

- Click on the name of their firm’s plan (the plan name is located on the main screen).

- Click on “User Preferences.”

- Participants can receive paper statements and copies of confirmation notices whenever they like.

Participants can switch between the “Quarterly” and “Online Only” options whenever they like.

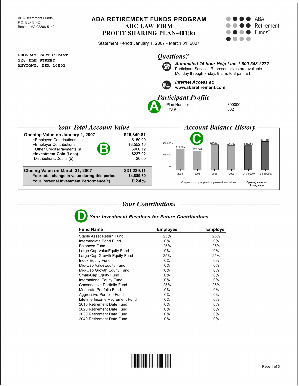

How to read the Participant Statement (page 1)

- Participant Profile Information: Listed in this area are the options available to access a participant’s account. The personal profile information is provided for quick reference.

- Your Total Account Value: This section provides a summary of the opening and closing value of the participant’s account along with the changes in value and personal investment performance.

- Account Balance History: A bar chart allows a clear visual comparison of the participant’s opening and closing balance for the statement period, along with the year-end closing balance for the last four years to see how the account has changed.

- Your Contributions: This section lists the participant’s current investment elections by fund and source for future contributions.

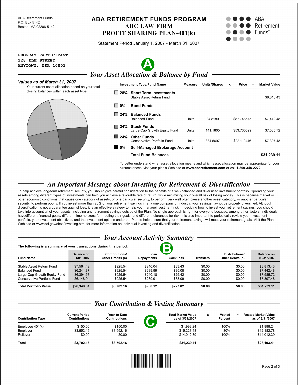

How to read the Participant Statement (page 2)

- Your Asset Allocation & Balance by Fund: The chart shown indicates the participant’s overall investment allocation by investment type. It also contains detailed information about the participant’s investment units/shares and total market value of each fund as of the end of the period.

- Your Account Activity Summary: This section summarizes the participant’s transactions during the period, broken out by fund, including beginning balance, contributions, loan repayments, gains/losses, fees, transfers, distributions and ending balance.

- Your Contribution & Vesting Summary: The statement period and year-to-date contributions are listed by source to track the type of money in the account. The participant will also find a summary of his or her vested percentage to track the total amount he or she presently owns of the contributions to the account and associated earnings. Pre-tax elective, After-tax, Roth 401(k), Rollover, Qualified Nonelective (QNEC), Qualified Matching (QMAC) and Safe Harbor contributions (other than QACA Safe Harbor contributions) are always 100% vested.

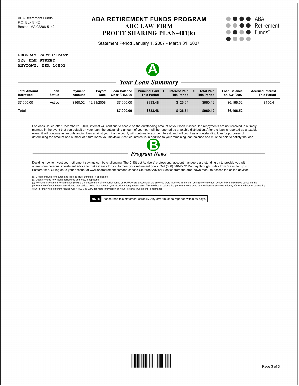

How to read the Participant Statement (page 3)

- Your Loan Summary: If the participant’s plan allows for loans, this section will detail loans issued and loan payments made during the period and important information the participant will need to keep track of the loan(s).

- Program News: Each statement will have a message from the Program to the participant regarding Program news.

Other participant communications automatically provided by the Program

Summary of Disclosure Document

The Summary of Disclosure Document, which the Program provides, contains current information on all of the investment options for the plan. The Summary of Disclosure Document is updated and sent to all participants each year, as well as provided in the enrollment kit. Participants may request a hard copy of the Annual Disclosure Document at any time.

Annual Disclosure Document

The Annual Disclosure Document, which the Program provides, contains more detailed information on all of the investment options and fees for the plan. The Annual Disclosure Document is updated and mailed to all Plan Administrators each year, and provided to participants online after login. Participants may request a hard copy of the Annual Disclosure Document at any time.

Required Minimum Distribution (RMD) Notices and/or Payments

SECURE 2.0 increased the required minimum distribution age further to 73 starting on January 1, 2023 – and increases the age further to 75 starting on January 1, 2033. Upon a participant’s attainment of age 73 (75 in 2033), the Program will send him or her a questionnaire to determine if the participant is subject to the RMD regulations. The Program will ask that the participant verify information on file, or provide an update should anything have changed. For example, if the Program’s records reflect that the participant is actively employed, but that is not the case, the participant will have an opportunity to provide correct information so that the Program can accurately calculate his or her RMD.

While ensuring that affected participants withdraw their RMD prior to the applicable deadline is the plan sponsor’s responsibility, the Program provides assistance. For more information on RMDs and the Program’s role, see the Required Minimum Distributions section.

Form 1099-R

All plan participants receive a Form 1099-R in the year following the year in which a withdrawal, distribution or defaulted or deemed distributed loan occurred. The Program sends the Form 1099-R to the participant’s address of record. Rollover distributions are reported in Box 7.

Confirmation Notices

All plan participants receive a confirmation notice for certain changes to their account. The Program sends the confirmation notices to the participant’s address of record. These confirmation notices are issued for the following transactions: Transfers (including rebalance or reallocation), investment election changes, address changes, marital status changes, name changes and beneficiary designation changes.

Participant communications provided by the Program Administrator

As the Program Administrator, you are responsible for providing participants with the following:

You are responsible for giving participants the:

Enrollment Package for New Participant

Upon request, the Program can provide you with a hard copy of the enrollment materials that contain all of the information a participant needs to enroll in the plan. Participants need to receive an enrollment kit within 30 days before their eligibility date (or, if your plan allows for immediate eligibility, upon a participant’s eligibility date) so they can make timely decisions about their investment options and/or participation. While some portions of the enrollment kit remain electronic even in hard copy, participants can request paper copies of that material through the Customer Service Center at any time.

Summary plan description (SPD)

The SPD is a summary of the plan provisions. It includes information such as eligibility, vesting, employee rights and appeal procedures. As Plan Administrator, you must provide the SPD as follows:

- For new participants and beneficiaries: Within 90 days after a plan participant or beneficiary becomes eligible for the plan. Beneficiaries become eligible for the plan on the death of the participant. This requirement also includes distributing any existing summaries of material modifications (SMMs) to the SPD.

- For new plans: To participants within 120 days after the plan is adopted or effective, whichever is later.

- Reissued SPDs: To participants and beneficiaries within 210 days after the end of the fifth (or 10th) plan year following the year that the last SPD was issued. SPDs must be reissued every five years if there have been any changes to the plan. If there were no changes in the last five years, the SPD must be reissued after 10 years.

Summary of material modifications (SMM)

If there has been a material modification to the plan, an SMM (or a revised SPD) must be given to participants and beneficiaries. An SMM notifies participants and beneficiaries of the change. It acts as an amendment to the SPD until a new SPD is developed. The SMM must be sent to all plan participants and beneficiaries within 210 days after the end of the plan year in which the change occurred (or, if later, the plan year in which the plan amendment making the change was adopted).

Summary annual report (SAR)

The SAR is a summary for participants of basic financial information from the Form 5500. It includes information on the assets and liabilities of your plan, payments and receipts for the last plan year. The Program provides the SAR along with the Form 5500. You should give the SAR to each plan participant, beneficiary and alternate payee annually. The SAR must be furnished no later than nine months after the close of the plan year. This deadline provides two months after the Form 5500 filing deadline to distribute the SAR. (Note that if the Form 5500 filing deadline is extended, the SAR is due two months after the extended due date.)

Participant Disclosures including Glossary of Investment Terms

The Department of Labor (DOL) requires the Plan Administrator to disclose investment and fee-related information to each employee eligible to participate in the plan, as well as other individuals who maintain accounts in the plan, such as beneficiaries of deceased participants, alternate payees who receive an award of benefits due to a Qualified Domestic Relations Order, and participants who terminated employment with the plan sponsor.

While this is a Plan Administrator responsibility, the Program mails Participant Disclosures annually to those participants who are recorded on the Program’s recordkeeping system. Therefore, if you have a 401(k) plan, it is important to keep the Program notified when an employee becomes eligible to participate in the plan, even if he or she is not participating, so that the Program can satisfy this obligation on your behalf; otherwise the Plan Administrator will need to ensure delivery of the disclosures. Please refer to this brochure entitled ” Participant Disclosures: A Guide for Plan Administrators”

The Investment Glossary is available on the home page of the Program’s website.

In addition, you must provide:

Notice to plan participants of firm-specific allocated plan expenses (e.g., legal, audit, third party administrator fees) to participant accounts not less than 30 days and not more than 90 days before the effective date of the charge.

The Program will provide you with the enrollment kits and Participant Disclosures that you need to distribute (other than the firm-specific expenses noted above). For the SPD, SMM and SAR, you must review and either distribute electronically or make copies for your participants.

Statements are sent directly to participants; Participant Disclosures are sent directly to those participants and eligible but not participating employees that are recorded on the Program’s recordkeeping system; plan total information and forfeiture account activity are sent directly to the Plan Administrator.

Participant communications provided on request

The participant or beneficiary may request plan information from the trustee or Plan Administrator at any time. As Plan Administrator, you are required to provide the information within 30 days, unless there is a justifiable reason for the delay. The participant may request:

- Copies of the financial reports (e.g., Form 5500, audit reports, SAR).

- Copies of plan documents (e.g., adoption agreement, plan document, SPD, SMM).

- A participant statement. This statement must be given quarterly if the plan permits participants to direct their investments and only once a year if the plan does not permit the participants to direct their investments. Also, the plan must provide a statement no more than once in a 12-month period, upon written request, to a plan beneficiary other than the participants referenced in the first sentence of this paragraph. The statement must include the participant’s accrued benefit and vested percentage or how much longer the participant must work to become vested. The Program issues statements on a quarterly basis and the statement includes the participant’s vested percentage, which is based on the information you provide to the Program (e.g., date of hire, termination, rehire, etc.).

- Participant Disclosures including glossary of investment terms – Plan-related and investment-related disclosure materials mandated by ERISA 404a-5.

Again, upon receiving a request in writing

from the participant or beneficiary, you must provide the information within 30

days (60 days for the participant statement), unless there is a justifiable

reason for the delay. The Program can assist you with these participant

communications as needed.